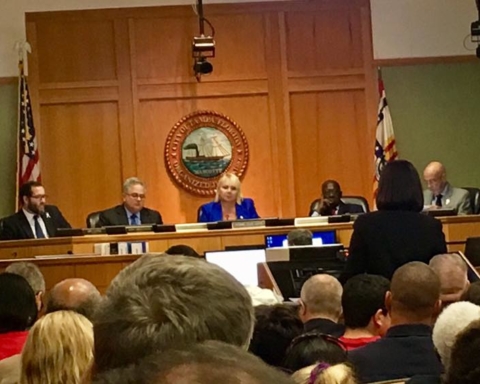

Saying it was “largely not of our making,” Tampa mayor Bob Buckhorn made the case Thursday for raising the city’s millage rate for the first time in 29 years.

“The day of reckoning has come,” the mayor told the City Council, emphasizing that the need for more revenue was an amalgamation of several factors having nothing to do with his administration – factors such as the debt due on projects going back to Dick Greco’s time in office two decades ago, decisions made by the Florida Legislature, and even the aftermath of the Great Recession.

Submitting his $974 million budget for FY 2018 (an increase of $68 million from last year), the mayor is requesting that the millage rate rise from $5.73 to $6.32 for every $1,000 of taxable property value.

“It will allow us to continue to invest in our infrastructure, invest in our quality of life, invest in our people, and invest in this community,” he said.

That would average out to a $23 monthly increase in South Tampa, he said, where the average priced home is set at $296,000.

In District 5, home to some of the most low-income residents in the city and where the average assessed valued home is $55,000, the increase would be approximately $2.25 a month.

One of the biggest challenges facing the city is paying the debt used to build police and fire stations in 1996. Under how those bonds were structured, the city was not allowed to refinance thet loan, which the mayor said would ordinarily be the case. Thus, the first payment of $6 million is now due, with the payment going up to more than $13 million next year.

Another $6 million to pay off a Section 8 loan from the Dept. of Housing and Urban Development to build the Centro Ybor complex is also coming due.

Buckhorn also shared charts showing how many millions of dollars in revenues the city no longer has captured due to the recession and the Save Our Homes constitutional amendment that locks in property tax increases at 3 percent. The Legislature has already placed a constitutional amendment on the 2018 ballot that will expand the homestead exemption, which city officials say will take out an immediate $6 million in revenues.

Societal changes have also resulted in less revenues. Back when most residents owned land telephone lines, the revenue from the community services tax was robust, with nearly $30 million in revenue in 2007. As people now almost exclusively use cellphones, the city has seen a reduction of over $68 million in that line item over the past decade.

The city funds a number of nonprofits, but this year all are expected to take a 10 percent “haircut.” He said there would be “two or three” that will no longer receive any city funding (he did not list who those groups are).

Buckhorn said he also feared the GOP-controlled Legislature taking away more control of local governments to enact their own millage increases. “It is important that if we do something, we do it now, before we can’t do it, because I guarantee that they will try to make sure that we can’t do anything, and that we are totally dependent upon them for their willingness to allow us to run our own shop,” he said.

The mayor’s entire presentation took almost 90 minutes to deliver, as he gave a version of his State of the City address to discuss all of the projects that the city is paying for.

One positive note is how solid the city’s pension contribution funds are for general employees and the police and fire departments.

Buckhorn met with all seven council members earlier in the week to prepare them for his request. Councilman Frank Reddick said on Wednesday that the mayor had convincingly made his case.

“It’s not this mayor who put us in this situation,” he said. “Now the bill collector is coming in January, and saying ‘pay us our money.’ And we’ve got to pay that money, or we’ll be in trouble.”

The Council will host two public hearings on the proposed budget in September.