Last shelter used for Hurricane Irma evacuees closes

The last shelter used for Hurricane Irma evacuees has closed in Miami-Dade County.

The last shelter used for Hurricane Irma evacuees has closed in Miami-Dade County.

Florida’s western Panhandle, the one area of the state spared the impact of Hurricane Irma nearly a month ago, is

State officials say Hurricane Irma caused more than $2.5 billion in damage to Florida’s agricultural community.

The Florida House of Representatives graphics team has done it again, putting together an uplifting 5-minute clip about the state’s

Gov. Rick Scott on Thursday declared a state of emergency in 29 Florida counties as Tropical Storm Nate seems headed for the state. Scott issued Executive Order 17-262 declaring a state of emergency in Escambia, Santa Rosa, Okaloosa, Walton, Holmes, Washington, Bay, Jackson, Calhoun, Gulf, Gadsden, Liberty, Franklin, Leon, Wakulla, Jefferson, Madison, Taylor, Hamilton, Suwannee, Lafayette, Dixie, Columbia, Gilchrist, Levy, Baker, Union, Bradford, and Alachua counties.

Florida’s western Panhandle, the one area of the state spared the impact of Hurricane Irma nearly a month ago, is

Tropical Depression 16 is expected to intensify into a tropical storm within 24 hours while traveling north into the Gulf of Mexico.

Gov. Rick Scott Monday has ordered flags at half-staff “in honor and remembrance of the victims of the act of

Louisiana is helping Florida process its thousands of unemployment claims related to Hurricane Irma. The Louisiana Workforce Commission, the state’s labor department, said Thursday that it reached out to Florida to offer assistance.

Florida State University President John Thrasher announced the members of the President’s Advisory Panel on University Namings and Recognitions, according to a news

In the wake of Hurricanes Harvey, Irma and Maria, U.S. Senators Marco Rubio and Bill Nelson, along with 26 U.S.

A House Republican on Friday proposed a measure that seeks to ensure power restoration for nursing homes and hospitals is a priority

Crisis, what crisis? Just a year after dire predictions that the state’s economy was in peril due to rising insurance costs, Florida businesses could see an average 9.3 percent reduction in workers’ compensation premiums in the coming year under a rate filing Insurance Commissioner David Altmaier will consider later this month.

Storms are a fact of life for the 20-plus million that call ourselves Floridians. Mother Nature reminded us of this

It’s clear that Agriculture Commissioner Adam Putnam has been running a careful race for Florida governor. And Republican voters like what

John Morgan — who has been flirting a political campaign — is leading the Democratic field in the Florida governor’s

A Broward County nursing home has expanded a lawsuit challenging moves by Gov. Rick Scott‘s administration that effectively shut down the facility after residents died following Hurricane Irma.

Florida State University President John Thrasher announced the members of the President’s Advisory Panel on University Namings and Recognitions, according to a news

In the wake of Hurricanes Harvey, Irma and Maria, U.S. Senators Marco Rubio and Bill Nelson, along with 26 U.S.

Raises will be provided to 16 upper-level and mid-level employees of Enterprise Florida, as the state’s business-recruitment agency does away

Following the worst mass shooting in U.S. history earlier this week in Las Vegas, two Florida lawmakers announced legislation designed to temporarily prevent access to firearms for individuals at a high risk of harming themselves or others. The bill (HB 231), filed Thursday by Jacksonville Sen. Audrey Gibson and Lantana Rep. Lori Berman – both Democrats –would allow family, household members, and law enforcement to obtain a court order with “demonstrated evidence” the person poses a significant danger to themselves or others, including…

Don’t politicize tragedy. That’s on page 1 in the standard response manual for how gun rights supporters respond to a

Drawing on lessons learned after a nightclub massacre last year in Orlando, Attorney General Pam Bondi and members of her

Gov. Rick Scott Monday has ordered flags at half-staff “in honor and remembrance of the victims of the act of

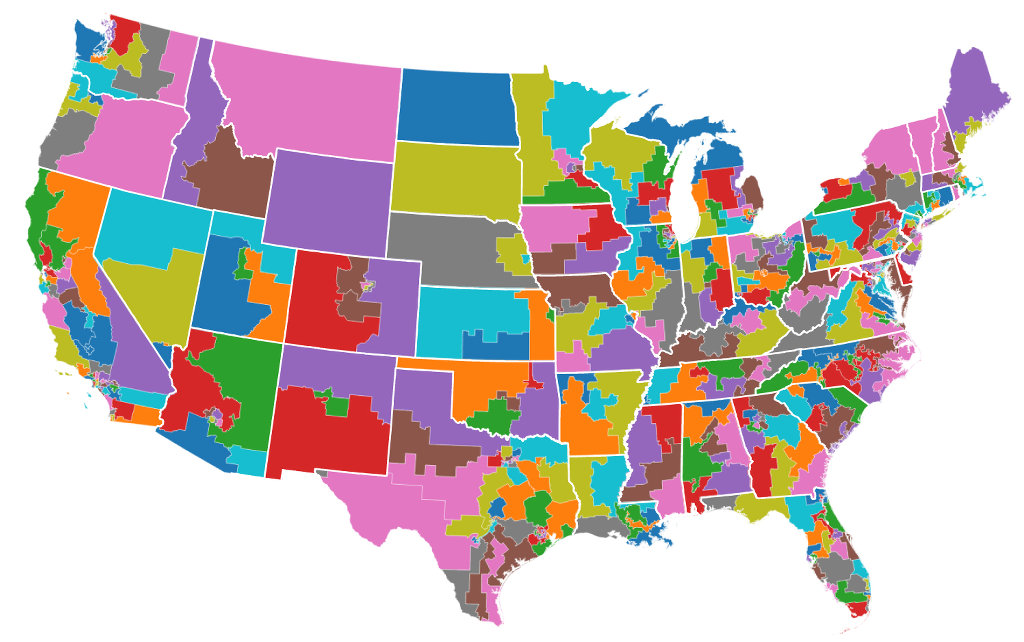

The term gerrymandering was coined over 200 years ago. On March 26, 1812, the Boston Gazette first used the term in describing the redrawing of a Massachusetts state senate district. Gov. Elbridge Gerry, a member of the Democratic-Republican Party, said the district resembled a salamander. Gerry’s name was linked to the last part of salamander, and the term gerrymandering was born.

Declaring it is time for Florida to “modernize” it’s voting systems, Democratic gubernatorial candidate Chris King unveiled a policy statement

Gov. Rick Scott set the execution of Michael Lambrix, who’s been on Death Row for 33 years, for 6 p.m. Oct. 5, the Governor’s Office announced

In a case stemming from the 1976 strangulation of a 13-year-old girl, the Florida Supreme Court on Thursday rejected arguments