As the Nov. 30 end of the hurricane season approaches, Floridians should be thankful. While this year’s storms Hermine and Matthew brought an end to the state’s decade-long hurricane drought, they easily could have been stronger or cut a more destructive path.

As the Nov. 30 end of the hurricane season approaches, Floridians should be thankful. While this year’s storms Hermine and Matthew brought an end to the state’s decade-long hurricane drought, they easily could have been stronger or cut a more destructive path.

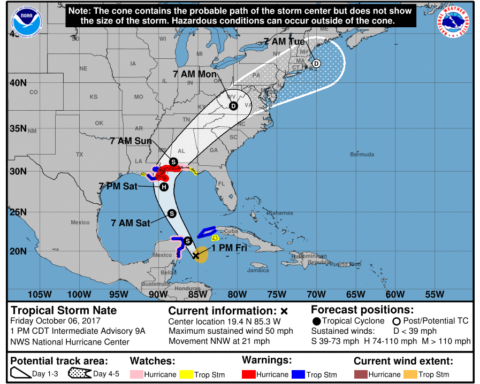

Indeed, had Hurricane Matthew tracked just 20 or more miles further west, it would have raked the entire east coast of Florida, bringing the full force of a Category 4 storm to the most populated and wealth-concentrated coastline in the region. Insured losses could have topped $35 billion.

That’s not to say the actual losses were trivial or insignificant. Thousands of homes and businesses were damaged, especially along Florida’s northeast coast. As of Oct. 27, the state reported more than 100,000 Hurricane Matthew-related insurance claims, and thousands more are expected to be filed in coming months. Ultimately, total losses are expected to reach $5 billion.

But thanks to responsible decisions made by Gov. Rick Scott and the Legislature over the past several years, coupled with trends in the global economy, homeowners are not expected to see insurance rate increases because of these storms.

Part of the luck Florida has experienced over the past decade is due not only to Mother Nature, but also to the reinsurance market. Reinsurance is insurance for insurance companies; that is, when an insurance company experiences catastrophic losses due to a major like a hurricane, its reinsurance protection kicks in and pays out a pre-negotiated percentage of claims.

Due to a realignment in the global capital markets, reinsurance prices have plummeted over the past several years, ushering in a “buyers’ market” that insurance companies have used to export more of their risk abroad and write more policies at home. Lawmakers and state regulators took note of this trend. Among other important insurance reforms, they have allowed state-run Citizens Property Insurance Corp. (Citizens) and the Florida Hurricane Catastrophe Fund (Cat Fund) to purchase reinsurance protection and other risk-transfer products without raising rates on consumers.

Thanks to these investments, based on current preliminary loss reports, it appears the state is poised ultimately to receive an influx of $1 billion in foreign capital to help pay these hurricane claims. These same reports estimate this amount could double to $2 billion, since roughly 50 percent of aggregate claims amounts will be paid for by foreign reinsurance entities.

This is significant. If private insurance companies were responsible for a higher share of their losses, they would have to dig deeper into their surplus accounts, which have to eventually be replenished—usually through rate increases on their consumers when policies come up for renewal. Instead, policyholders will be gratified that insurance companies took advantage of low reinsurance rates to purchase more of their own protection.

Current projections indicate that losses incurred by state-run Citizens and the Cat Fund will not trigger their reinsurance protection this time around. However, lawmakers and regulators alike should not forget how close Hurricane Matthew came to doing so. When making their decisions to protect consumers, the state’s property insurance market and taxpayers, Florida policymakers should not assume the next bullet will merely graze us like Matthew did.

___

Christian Cámara of the R Street Institute is a member of the Stronger Safer Florida coalition.