Consumer sentiment among Floridians dropped six-tenths of a point in September to 95.5 from a revised figure of 96.1 in August. Similarly, the University of Michigan’s nationwide consumer sentiment index decreased slightly in September.

Of the five components that make up the index, three decreased and two increased.

Perceptions of one’s personal financial situation now compared with a year ago decreased six-tenths of a point, from 87.8 to 87.2. On the other hand, opinions as to whether now is a good time to buy a big-ticket household item such as an appliance increased six-tenths of a point, from 102.6 to 103.2.

“The behavior of these two components of the index indicate that perceptions of present economic conditions among Floridians remain unchanged from last month,” said Hector H. Sandoval, director of the Economic Analysis Program at University of Florida’s Bureau of Economic and Business Research.

Expectations of personal finances a year from now showed the biggest drop this month, down 4.4 points from 104.8 to 100.4. Anticipated U.S. economic conditions over the next year decreased 2.6 points, from 95.8 to 93.2. Expectations of U.S. economic conditions over the next five years showed the greatest increase, rising 3.7 points from 89.6 to 93.3. These three components together represent expectations about future economic conditions, which decreased in September overall, despite the long-run positive expectations held by the population.

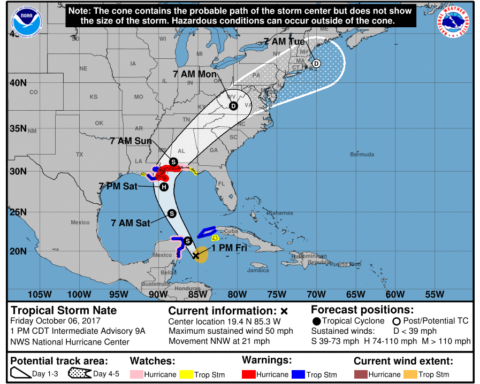

“Most of the pessimism in September stems from negative expectations regarding the personal financial situation of Floridians in the short-run. These expectations reflect in part the current and expected effects of the hurricane season on the state,” Sandoval said.

Hurricane Harvey made landfall Aug. 25 and flooded parts of Houston and southeastern Texas, forcing the closure of several oil refineries and increasing gas prices in the U.S. In Florida, the average price for a gallon of gasoline went up by 36 cents, according to AAA.

Just over three weeks later, Hurricane Irma battered Florida and caused a decline in overall economic activities and economic growth in the state, triggering business closures and job losses. For the week ending Sep. 16, Florida had the nation’s second-largest increase in initial claims for unemployment insurance.

“Nonetheless, as the state continues to recover, these trends will likely reverse as rebuilding efforts take place. Hurricane Irma should not erase the positive labor market conditions that have prevailed in the state for the past few years,” Sandoval said.

The Florida unemployment rate declined one-tenth of a percentage point in August to 4.0 percent. Job gains were led by the professional and business services industry, followed by trade, transportation and utilities, and the education and health services sector. The latest unemployment report does not account for job losses caused by recent storms, but it confirms the positive trends observed in previous years.

In their last meeting, the Federal Open Market Committee observed that, “Despite the devastation caused by the Hurricanes Harvey, Irma and Maria, the storms are unlikely to materially alter the course of the national economy over the medium term.”

Sandoval said, “Overall, consumer sentiment in Florida continues to be positive. However, next month’s reading will be very valuable in assessing the impacts of the storms on consumer sentiment as the holiday shopping season gets closer.”

Hurricane Irma also affected this month’s survey data collection. Typically interviews are spread out over each day of the month, but due to state-mandated university closures prior to landfall, calls were not made for six days from Sep. 8-13. There was a slight shift in the number of responses by region. On average in 2017, the southeast region of the state contributed 30 percent of survey responses, but only 24 percent for September. Other demographics did not shift by more than one or two percentage points.

Conducted Sep. 1-28, the UF study reflects the responses of 470 individuals who were reached on cellphones, representing a demographic cross section of Florida.

The index used by UF researchers is benchmarked to 1966, which means a value of 100 represents the same level of confidence for that year. The lowest index possible is a 2, the highest is 150.

Details of this month’s survey can be found at http://www.bebr.ufl.edu/csi-data.

Republished with permission of the University of Florida.