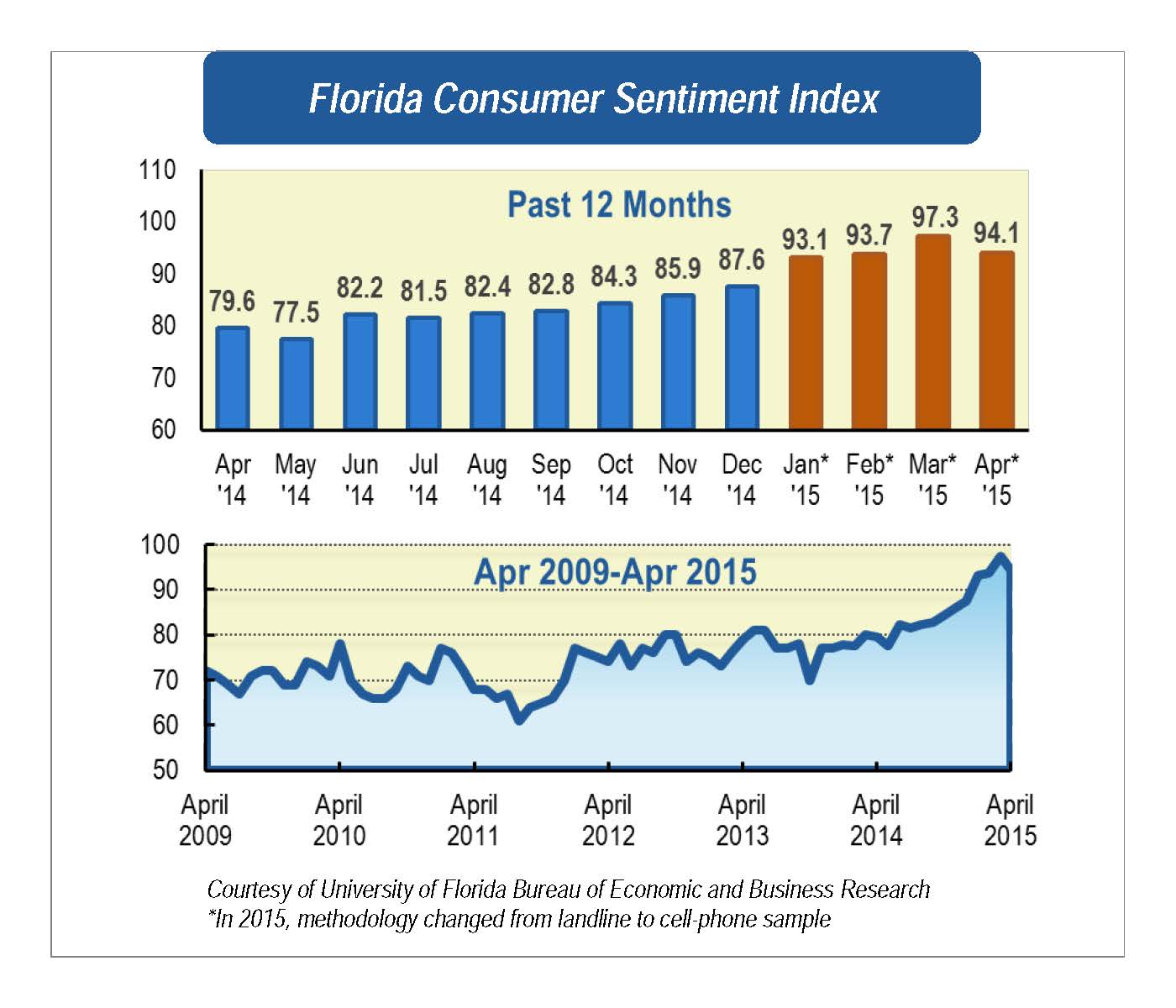

Consumer sentiment among Floridians dropped more than three points in April to 94.1, according to a monthly University of Florida survey. All five components that make up the index declined.

Perceptions of personal finances now compared with a year ago fell nearly four points from 88.1 to 84.3, while expectations of personal finances a year from now declined from 104.7 to 103.3.

Expectations of U.S. economic conditions over the next year dropped from 95.4 to 91.8, while anticipation of U.S. economic conditions over the next five years decreased from 92.4 to 90.2.

The most significant drop in the overall index was among households with an annual income over $50,000, which experienced a nearly five-point decline while lower-income households were unchanged. The major contributor to the decrease was expectations of personal finances a year from now: Higher-income households fell from 109.7 to 101.2, while lower-income households rose from 101.5 to 108.3.

“The overall sentiment index had been rising in most months since May, to a post-recession high of 97.3 last month,” said Chris McCarty, director of UF’s Survey Research Center at the Bureau of Economic and Business Research. “This decline comes at a time when most other economic indicators are positive. It appears that upper income households are anticipating a slowdown in those parts of the economy that affect them the most.”

The stock market has mostly risen in April and is up 1.3 percent for the year, but some individual investors may feel uneasy as they observe roller-coaster spikes and dips that are partly because of uncertainty about the Federal Reserve raising short-term interest rates.

On the other end of the income spectrum, gas prices have remained low, a boon to lower-income households that may in part explain their increased optimism.

Regarding the question of whether now is a good time to buy big-ticket items such as an automobile, consumer rating plummeted more than five points from 106.0 to 100.7.

There was also a very sharp decline of nearly 12 points among those aged 60 and over on perceptions of personal finances now compared with a year ago.

Most indicators still reflect a strong Florida economy. The March unemployment rate for Florida remained unchanged from February at 5.7 percent, only two-tenths of a percentage point higher than U.S. unemployment rate of 5.5 percent. Florida housing prices continued to rise in March with the median price for a single-family home at $190,000, up 9.2 percent from a year ago.

Leisure and hospitality led in number of jobs increased, which attracted a record number of visitors both from the U.S. and worldwide. The increase in Florida visitors also contributed to other service jobs such as those in retail trade. These tend to be lower-wage jobs, leaving the growth in Florida wages lower than other states.

For example, from 2006 and 2014, wage growth in Texas outpaced Florida for 27 of 35 months. Wage growth in Texas was 25.7 percent higher in 2014 than in 2006, compared with an increase in Florida of only 16 percent. In the third quarter of 2014, average weekly wages were $826 in Florida, $988 in Texas and $1,631 in the District of Columbia, the highest in the country.

“Florida is a great example of the hesitation of the Federal Reserve to raise short-term interest rates. In most ways, the Florida economy looks sound. We are creating jobs, housing prices have made huge gains and some industries are doing well,” McCarty said. “But something just isn’t quite right with slow wage growth and low labor force participation. The Federal Reserve will likely raise interest rates this year, probably in June, but perhaps not until September. The first hike will almost certainly be low, but it is important to raise them to show that the economy does not need zero percent interest rates to survive.”

Conducted April 1-19, the UF study reflects the responses of 397 individuals reached on cell phones, representing a demographic cross-section of Florida.

The index used by UF researchers benchmark at 1966, which means a value of 100 represents the same level of confidence for that year. The lowest index possible is a 2. Highest is 150.

Details of the April survey are at http://www.bebr.ufl.edu/cci.